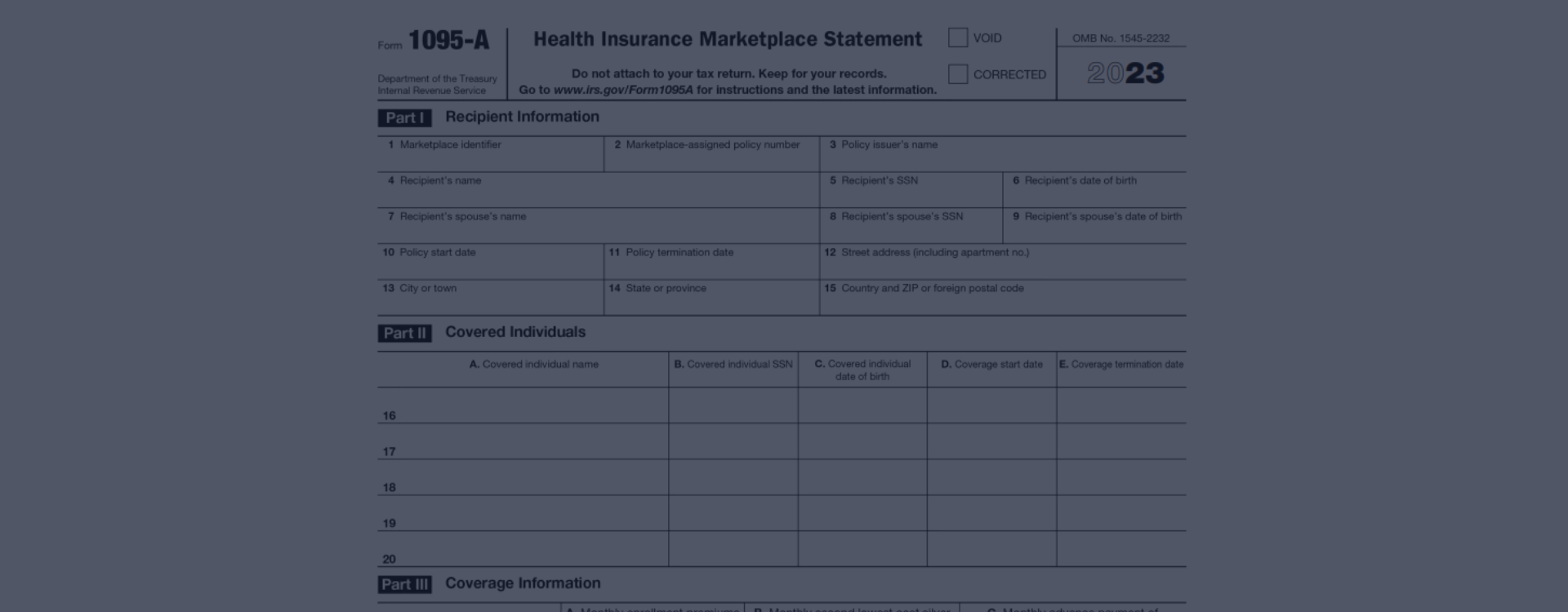

IRS Form 1095: Health Insurance Marketplace Statement

IRS 1095-A Form Role in the Taxation Realm

For those who don't know, IRS Form 1095-A, Health Insurance Marketplace Statement, is a widely known document. The government sends it to people who buy health insurance through the marketplace. This form contains information about your insurance coverage, such as who was covered in your household and which months they had insurance. It's used to verify that you had health insurance during the year, which may affect your tax return.

You can access the 1095-A printable form for free on our website, 1095a-health-insurance.com. Our page offers a wealth of resources to help you understand and fill out this essential tax-related document. The website provides easy-to-follow instructions and meaningful examples, which make the process less intimidating. You can also download Form 1095-A in PDF format for your convenience. Using these tools, you can accurately complete your Form 1095-A and ensure you're correctly reporting your health insurance information to the IRS. So, put your mind at ease and take advantage of these resources today!

Terms for the 1095-A Tax Form Eligibility

In the U.S., anyone who has purchased medical coverage through the marketplace has to file a Health Insurance 1095-A form at the end of the fiscal year. This statement provides information about your insurance plan that the IRS needs to make sure you've complied with the Affordable Care Act (ACA).

Example of the 1095-A Health Insurance Form Use

Let's imagine a woman named Nancy. She is a proud small business owner who has been busy building her dream for the last five years. Nancy doesn’t have access to employer-based insurance, so she had to find her own coverage. Thankfully, she could purchase a health insurance plan through the marketplace. Because of this, Nancy has to fill out the 1095-A health insurance form every tax season. The details she provides on this form are essentially a summary of her insurance for the year, which is why it's so important for compliance with the ACA. From here, the IRS can confirm that Nancy has met the minimum coverage required by law. It is an IRS 1095-A health insurance form responsibility that mustn't be overlooked, as non-compliance could lead to penalties.

Tips to Fill Out the 1095-A Form Online

Filling out your Marketplace Healthcare 1095-A form can feel like a daunting task, but worry not. We've got your back! We aim to make tax filing simple and stress-free for you. Start by gathering the necessary details before you get the 1095-A health insurance marketplace statement in 2023. This document is crucial as it contains all the information needed about your health coverage. Consider these four steps to make the process smooth.

Filing your taxes can seem daunting, but we're here to guide you through. One critical document is the 1095-A health insurance tax form, which you must complete accurately. This form, issued by your health insurance marketplace, contains critical data for your tax return.

File Form 1095-A on Time

It's essential to file this form on time. Here's the thing- you have until April 15 to electronically transmit or e-file Form 1095-A. Now, it's crucial to take note that submitting this form past the due date can result in penalties. Worse, providing false information may lead to severe repercussions, too. So remember, take care to submit Form 1095-A and provide accurate details. Let's not let the hustle of fiscal season overshadow the importance of proper tax filing. Your diligence can save you from unnecessary worries later on.

Healthcare 1095-A Form : Frequently Asked Questions

More About Form 1095-A & Health Insurance Marketplace

Please Note

This website (1095a-health-insurance.com) is an independent platform dedicated to providing information and resources specifically about the 1095-A tax form, and it is not associated with the official creators, developers, or representatives of the form or its related services.